How Oracles Enhance Smart Contracts Through Real-World Data

Understanding Smart Contracts and Their Limitations

Smart contracts are self-executing agreements with the terms written directly into code. While they offer automation and security, they rely on pre-existing data to function effectively. However, one limitation is their isolation from real-world information, which can hinder their applicability in various industries.

Smart contracts are a powerful tool, but they need real-world data to unlock their full potential.

For instance, if a smart contract was designed to execute a payment based on weather conditions, it would need accurate, real-time weather data. Without a way to access that information, the contract can’t fulfill its purpose, leading to potential failures in automation. This is where oracles come into play, acting as the crucial link between smart contracts and real-world data.

In essence, oracles provide the necessary data inputs that smart contracts lack, allowing them to operate seamlessly in a real-world context. By bridging this gap, they enhance the functionality and reliability of smart contracts across numerous applications.

What Are Oracles and How Do They Work?

Oracles are services that provide external data to smart contracts, enabling them to trigger actions based on real-world events. They can pull information from various sources, such as APIs, databases, or even IoT devices, ensuring that smart contracts have the most accurate and up-to-date data available. This process involves a series of steps, from data retrieval to validation before it reaches the smart contract.

For example, in a decentralized finance (DeFi) application, an oracle might provide the current price of a cryptocurrency to execute a trade. Once the oracle collects the necessary data, it transmits it to the smart contract, which then processes the transaction based on that information. This dynamic interaction allows smart contracts to respond to real-time market conditions effectively.

Oracles Enable Smart Contract Functionality

Oracles provide essential real-world data to smart contracts, allowing them to execute actions based on actual events.

Ultimately, oracles are pivotal in expanding the capabilities of smart contracts, enabling them to operate effectively in a variety of sectors, from finance to insurance. By providing accurate data, they ensure that smart contracts can make informed decisions based on the current state of the world.

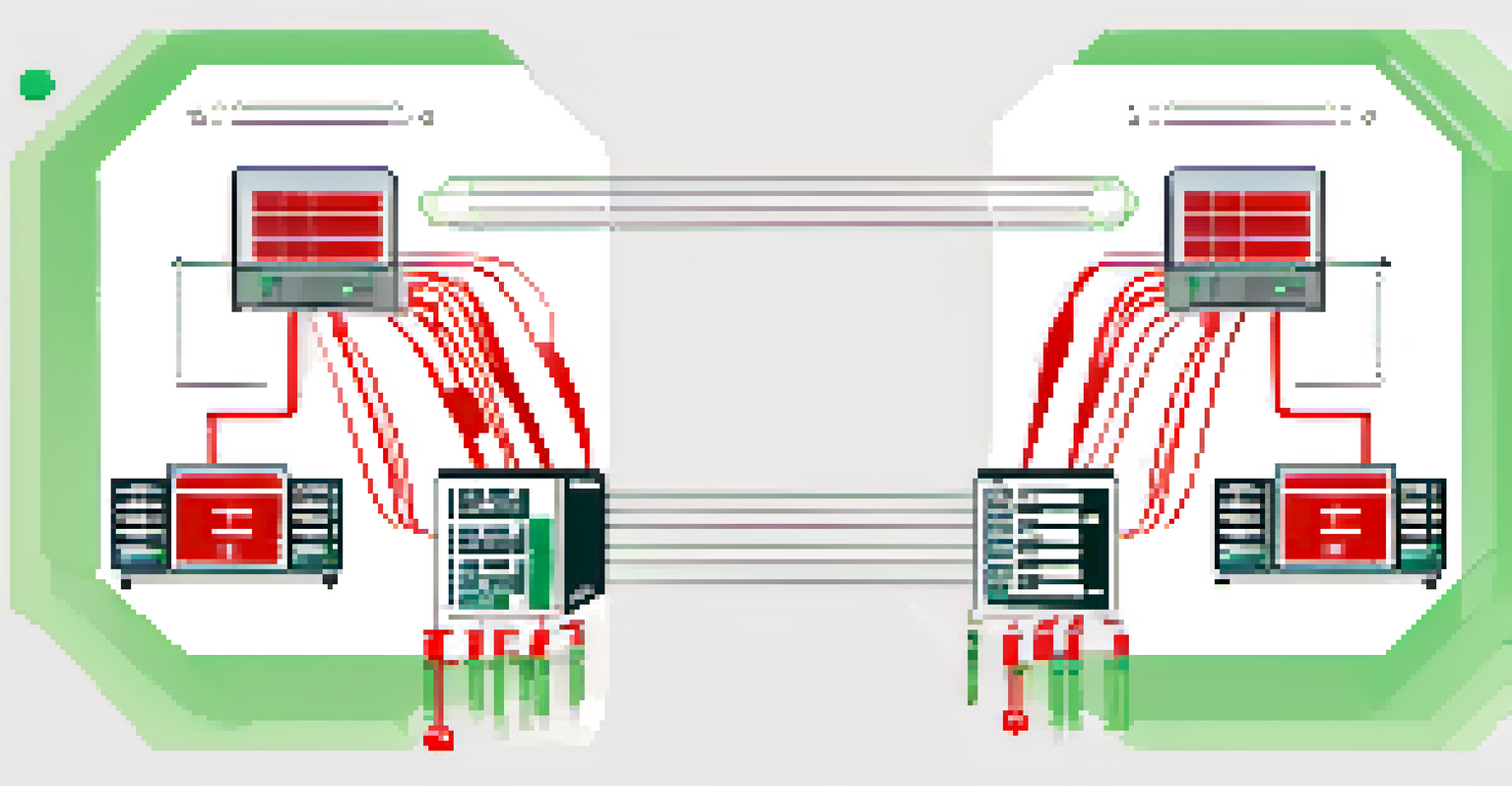

Types of Oracles: Centralized vs. Decentralized

Oracles come in two primary types: centralized and decentralized, each with its unique advantages and disadvantages. Centralized oracles rely on a single source of truth, which can be efficient but poses a risk, as the reliability lies in one entity. If this entity experiences issues or becomes compromised, it can jeopardize the entire smart contract's operation.

Oracles are the bridge between the blockchain and the real world, enabling smart contracts to interact with external data.

On the other hand, decentralized oracles aggregate data from multiple sources, which enhances reliability and reduces the risk of corruption. They employ consensus mechanisms to validate information, ensuring that the data is accurate before it's fed into the smart contract. This redundancy makes decentralized oracles a safer choice for critical applications.

Choosing between centralized and decentralized oracles depends on the specific needs of the smart contract. While centralized oracles may be faster and cheaper, decentralized oracles provide greater trust and security, which is essential for high-stakes transactions.

Real-World Applications of Oracles in Smart Contracts

Oracles have found numerous applications across various industries, enhancing the functionality of smart contracts in practical scenarios. In the insurance sector, for example, oracles can pull data from weather services to automate claims processing for policies tied to natural disasters. When conditions meet the predefined criteria, the smart contract can automatically trigger a payout, streamlining the entire process.

Another notable application is in sports betting, where oracles provide real-time game statistics and results. Smart contracts can automatically execute bets based on the latest data, ensuring that outcomes are fair and transparent. This not only enhances user experience but also builds trust in the platform.

Centralized vs. Decentralized Oracles

Choosing between centralized and decentralized oracles affects reliability and security, with decentralized options offering greater trust.

From supply chain management to real estate, the versatility of oracles allows smart contracts to adapt to various needs. By integrating real-world data, they provide solutions that enhance efficiency, transparency, and reliability in numerous applications.

Challenges and Risks of Using Oracles

While oracles significantly enhance smart contracts, they also introduce specific challenges and risks that must be considered. One major concern is the reliance on external data sources, which can be prone to inaccuracies or manipulation. If the data provided by an oracle is incorrect, it can lead to unintended consequences for the smart contract's execution.

Moreover, the security of the oracle itself is crucial. Centralized oracles are especially vulnerable to attacks, as a single breach can compromise the entire smart contract ecosystem. This is why many developers are turning to decentralized oracle solutions that offer better security through multiple data sources and consensus mechanisms.

In short, while oracles are essential for bridging the gap between smart contracts and real-world data, it’s important to choose the right type of oracle and implement robust security measures. Understanding these challenges can help developers build more secure and reliable applications.

The Future of Oracles in Blockchain Technology

As blockchain technology continues to evolve, oracles are expected to play an increasingly important role in enhancing smart contracts. With advancements in data integration and retrieval methods, the efficiency and reliability of oracles are likely to improve. This will enable smart contracts to access a wider range of data sources, making them even more adaptable.

Furthermore, as industries begin to embrace decentralized finance and smart contracts, the demand for trustworthy oracles will grow. This means that innovation in oracle technology will be essential to meet the needs of various sectors, from finance to healthcare. Developers and businesses alike will need to stay informed about the latest developments in oracle solutions.

Real-World Applications of Oracles

Oracles enhance smart contracts across various industries, from automating insurance claims to facilitating sports betting.

In conclusion, the future of oracles in blockchain technology is bright. They are set to become indispensable tools that empower smart contracts to operate effectively in an increasingly complex world filled with diverse data inputs.

Conclusion: The Importance of Oracles for Smart Contracts

In summary, oracles serve as vital connectors that enhance the functionality of smart contracts by providing them with real-world data. Their ability to bridge the gap between isolated blockchain environments and external information sources opens up a world of possibilities for automation and efficiency. As we've seen, oracles can significantly impact various industries, from finance to insurance.

While they come with challenges and risks, the benefits of using oracles far outweigh the drawbacks when implemented correctly. By understanding the different types of oracles and their applications, developers can leverage these tools to create more robust and reliable smart contracts.

Ultimately, as we move forward in the digital age, oracles will continue to play a crucial role in the evolution of smart contracts, enabling them to deliver on their promise of automation, transparency, and trust in real-world applications.