Liquidity Pools: The Backbone of Decentralized Exchanges

What Are Liquidity Pools and Why Do They Matter?

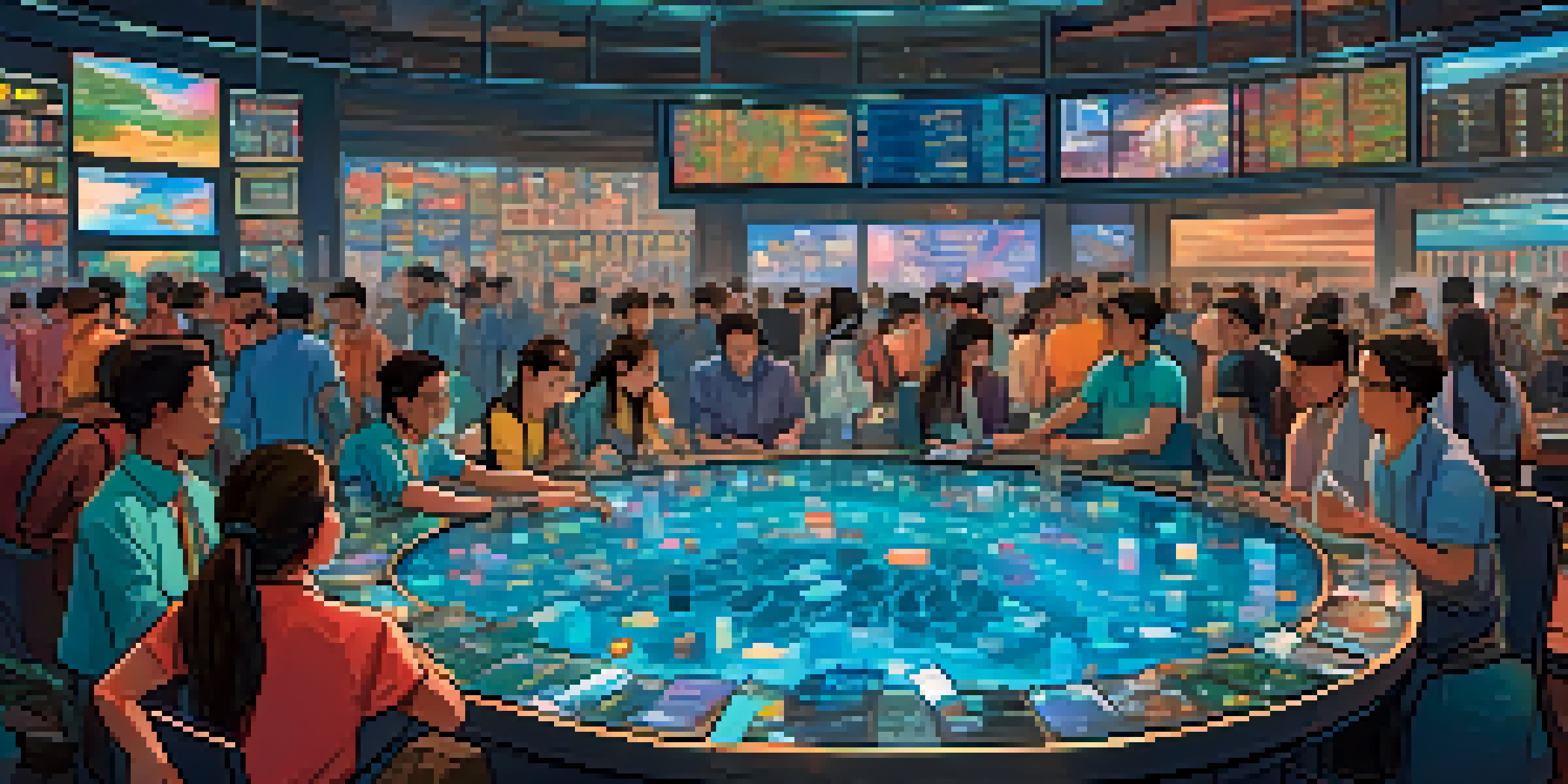

Liquidity pools are collections of funds locked in smart contracts, used to facilitate trading on decentralized exchanges (DEXs). They serve as a source of liquidity, enabling users to swap various cryptocurrencies without relying on a traditional order book. Imagine them as pools of water in a desert; traders draw from these pools to quench their thirst for quick and efficient transactions.

Liquidity is the lifeblood of financial markets. Without it, we would not have true price discovery.

These pools are crucial because they eliminate the need for a central authority, empowering users to trade directly with one another. This decentralized nature not only promotes a fair trading environment but also enhances user control over their assets. In a world where transparency and trust are paramount, liquidity pools rise to the occasion.

Furthermore, liquidity pools foster innovation within the DeFi (Decentralized Finance) space by allowing new projects to launch their tokens with immediate trading capability. They create opportunities for both seasoned traders and newcomers, making the crypto landscape more accessible and inclusive.

How Liquidity Pools Function: A Simple Breakdown

At the core of a liquidity pool is a smart contract that manages the funds contributed by users, known as liquidity providers (LPs). When LPs deposit assets into the pool, they receive tokens in return, representing their share of the pool. Think of it as a group project where everyone contributes resources, and each member gets a share of the final product based on their contribution.

When a trade occurs, the smart contract uses an automated market-making (AMM) algorithm to determine the price based on the ratio of assets in the pool. This dynamic pricing mechanism ensures that liquidity is always available, even if there’s a sudden surge in demand. It’s like a balancing act, where the more you trade, the more the prices adjust to reflect supply and demand.

Liquidity Pools Enable Decentralized Trading

Liquidity pools provide a decentralized way for users to trade cryptocurrencies without relying on traditional order books.

As trades are executed, LPs earn a portion of the transaction fees generated, providing them with an incentive to keep their assets in the pool. This creates a win-win situation where traders enjoy seamless transactions, and LPs benefit from passive income. It’s a collaborative ecosystem that drives the decentralized finance movement forward.

The Risks and Rewards of Participating in Liquidity Pools

While liquidity pools offer exciting opportunities, they also come with risks. One major concern is impermanent loss, which occurs when the value of the assets in the pool fluctuates significantly compared to holding them in a wallet. This phenomenon can result in LPs receiving less value when they withdraw their assets than if they had simply held them. It's a bit like a rollercoaster ride; thrilling, but it can leave you feeling a bit queasy if you're not prepared.

Decentralization is not a goal; it’s a means to an end. The goal is to create a financial system that is fair, accessible, and efficient.

However, the potential rewards can outweigh the risks. Besides earning transaction fees, some pools offer incentives such as governance tokens, allowing LPs to participate in decision-making processes for the platform. This adds another layer of engagement and ownership for participants, making them feel like true stakeholders in the ecosystem.

To mitigate risks, it’s essential for LPs to research different pools and understand the specific dynamics at play. Diversifying investments across various liquidity pools can also help spread risk while maximizing potential returns. Like any investment, knowledge is key, and informed decisions can lead to greater rewards.

Choosing the Right Liquidity Pool for Your Needs

With countless liquidity pools available, selecting the right one can feel overwhelming. Start by considering the pool’s trading volume and the assets involved. Higher trading volume generally leads to better liquidity and lower price slippage, which is vital for efficient trading. It’s like choosing a restaurant; you want to go where the locals are eating for the best experience.

Next, examine the fees associated with the pool, as they can vary significantly. Some pools charge high fees, while others might offer lower costs but less rewarding incentives. Balancing these factors is crucial to maximizing your returns without compromising on your trading experience.

Automated Market Makers Simplify Trading

AMMs utilize algorithms to adjust prices and ensure liquidity, allowing for seamless transactions in the trading process.

Lastly, don’t forget to check the community and development activity surrounding the pool. A strong, engaged community often indicates a healthy project with ongoing improvements and support. Engaging with communities on platforms like Discord or Telegram can provide valuable insights and help you make informed decisions.

The Role of Automated Market Makers in Liquidity Pools

Automated Market Makers (AMMs) are a key innovation behind liquidity pools. They allow users to trade assets directly from the pool without the need for traditional market makers, thereby revolutionizing how trades are executed. Think of AMMs as the engines that power liquidity pools, ensuring that trades are smooth and efficient.

AMMs use algorithms to set prices based on the current supply and demand within the pool. This means that as more people trade, the prices adjust automatically, which ensures that liquidity is always available. It’s a self-sustaining system that relies on mathematical principles rather than human intervention, making it both efficient and reliable.

Additionally, AMMs enable unique trading strategies such as arbitrage, where traders capitalize on price discrepancies across different exchanges. This adds another layer of opportunity for savvy traders looking to maximize their profits while contributing to the overall efficiency of the market.

Liquidity Pools Versus Traditional Exchanges: A Comparison

When comparing liquidity pools to traditional exchanges, the differences become quite evident. Traditional exchanges rely on order books, where buyers and sellers place orders that must match for a trade to occur. This system can lead to delays and inefficiencies, especially during times of high market volatility. In contrast, liquidity pools provide instant access to funds, enabling immediate trades regardless of market conditions.

Another significant difference is the level of control users have over their assets. In traditional exchanges, users must trust the platform to hold their funds securely, which can lead to concerns about hacks or mismanagement. With liquidity pools, users retain control of their private keys and funds, enhancing security and trust in the system.

Risks and Rewards for Liquidity Providers

Participating in liquidity pools can yield transaction fees and governance tokens, but it also involves risks like impermanent loss.

Moreover, liquidity pools often have lower fees than traditional exchanges, making them an attractive option for traders. As more users migrate to decentralized platforms, the advantages of liquidity pools become increasingly appealing, paving the way for a new era of trading.

The Future of Liquidity Pools and Decentralized Finance

As decentralized finance continues to evolve, liquidity pools are set to play a pivotal role in shaping the future of trading. Innovations like concentrated liquidity and cross-chain pools are already emerging, allowing users to maximize their capital efficiency and trade across different blockchain networks. This could be compared to the expansion of highways; as more routes open up, travel time decreases, and opportunities multiply.

Additionally, as liquidity pools gain traction, we can expect increased regulatory scrutiny to ensure user protection and fair practices. This will likely lead to more robust frameworks that balance innovation with security, fostering a healthier ecosystem for all participants. It’s a growing field that’s attracting attention from both users and regulators alike.

Ultimately, liquidity pools represent a fundamental shift in how we think about trading and asset management. They empower users to take control of their finances while enabling seamless transactions in a decentralized environment. As we look ahead, it's exciting to imagine how liquidity pools will continue to innovate and redefine our financial landscape.